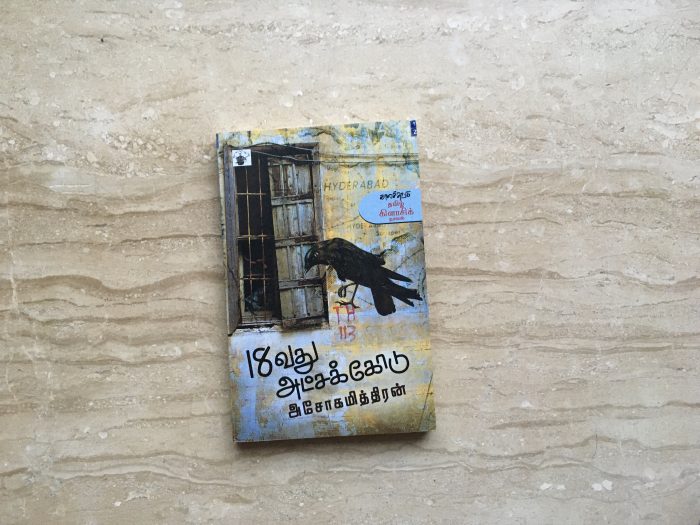

18avadhu atchakodu (18th latitude) is an interesting book by Ashokamitran. There’s hardly any ‘story’ and it feels like you’re simply observing the life of a young man over a few months. Those few months, it turns out, are historically important in the formation of a new nation – India.

Does he belong to India? Or to the Nizam state of Hyderabad, and in some way, Pakistan? This dilemma is accentuated further by lack of proper information – would the Indian army march to Hyderabad and subdue the Nizam? Or would the Razakkars sway it in favour of Pakistan?

Ashokamitran is unique. I can’t think of any other author who has this style of writing. Written in a very casual and underplayed tone, often laced with wry humour, the book seems like a light read to breeze through. At some point, you suddenly realise it is anything but that. In the background, slowly things unfold. Diaspora lifestyles, the Indian freedom, Razakkars uprising, Nizam’s flip-flops from Pakistan to sovereignty to India, Gandhi’s death, the annexations protests and riots – and finally, the plight of those who pay the price for these political games.

Ashokamitran’s handling of the tension between the Hindu-Muslim neighbours is unique. There’s no chauvinistic nationalism – just a play of emotions between people who belong to different religions at a time of conflict. What he leaves unsaid is what makes you think.

Another special mention is his ability to bring the landmarks, streets and lanes of Hyderabad / Secunderabad of 1947/48 to life as if it’s unfolding in front of your eyes.

I enjoyed reading the book. The English translation by Gomathi is supposed to be good too, and is available on Kindle.