Last year, in June, I liquidated most of my debt investments thinking that I would invest it in my own company.

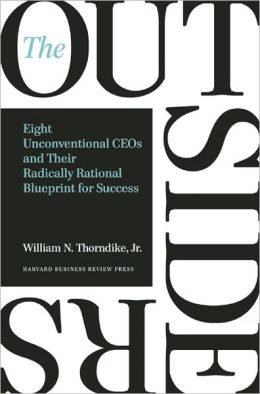

In that period, I also read this book – “The Outsiders”. I really liked the modus operandi of the entrepreneurs featured in the book. They were all capital allocators and had done very interesting things – many a time going against conventional ‘grow big’ logic. Those guys often would ask themselves, “which is the best option to put my next Rupee into?”. They would always seek an edge. And got out of businesses with leaky-boat economics. And invested heavily into businesses where they could build more competitive advantage.