Last year, in June, I liquidated most of my debt investments thinking that I would invest it in my own company.

In that period, I also read this book – “The Outsiders”. I really liked the modus operandi of the entrepreneurs featured in the book. They were all capital allocators and had done very interesting things – many a time going against conventional ‘grow big’ logic. Those guys often would ask themselves, “which is the best option to put my next Rupee into?”. They would always seek an edge. And got out of businesses with leaky-boat economics. And invested heavily into businesses where they could build more competitive advantage.

That got stuck in my head.

A few things happened – one of my key employees resigned and a few issues cropped up. I wanted to fix the issues at office before putting in more money.

Then few more things happened in July-Aug:

- Indian Rupee plunged to new lows against the dollar

- Inflation was raging

- Fear of US Fed tapering quantitative easing (monetary stimulus) increased

- People were totally annoyed by the ruling party – things didn’t look rosy

As a result, equity markets fell. Like ninepins. I kept thinking of Warren Buffett – “be greedy when others are fearful”.

Having gone through the 2008 stock market fall, I sensed an opportunity. I stopped and asked myself the same question. “Which is the best option to put my next Rupee into?”.

I evaluated my options at that time along with work involved:

- fixed deposits earning 7-10% pretax. No research needed.

- govt backed debt investments that might earn 8-9% pretax. Again, no research needed.

- corporate backed debt investments that might earn 10-12% pretax. Never done this.

- equities in companies with unpredictable returns. Quite a bit of research needed. Plus I have no control over what could happen once I invest.

- my own business. I knew what I could expect. Plus, I had control over things. Lot of work involved in running the business.

Which was a better choice? Clearly, my interests were in either or both of 4 & 5. Options 1 to 3 weren’t exciting.

Should I take a chance with equities? Or in my own business where I knew my returns to a good extent?

Evaluating the edge

I had been tracking few companies for a while, mostly ideas cloned from people like Rohit Chauhan, Ayush Mittal and Prof. Sanjay Bakshi. I won’t claim that I did excellent analysis, but I knew my risk reasonably enough. And I was confident enough because I survived through the 2008 market fall – and took a lot of lessons from it. One thing I didn’t know was how long the bear market would last – 1 month or 1 year or 5 years? But the underlying businesses were all doing pretty well. As long as I didn’t get pressurized to sell at wrong time, I knew I would do reasonably well.

I knew a lot about my own business, esp economics side of it – the RoCE, asset turnover, operating margins, operating cashflow, capex, etc. What kind of returns to expect and importantly, how much work that involves. I simply compared it with the companies in my research list and asked myself these simple questions:

- what’s the downside risk?

- what’s the upside potential?

- how much effort is involved compared to my own business to generate similar results?

I decided to invest in equities and skip my own business. A few entrepreneurs might not agree with it – but that’s what I did.

I had more upside edge in equity at that stage compared to my business (which is capital intensive with low asset turnover) and I needn’t slog it out at office.

I won’t claim to be intelligent to have predicted what happened over next 1 year. Yes, I expected a favorable result, but nowhere close to what actually happened. My edge was in knowing that the price was favourable, downside risk was low, these were good quality businesses and hence could do well over few years.

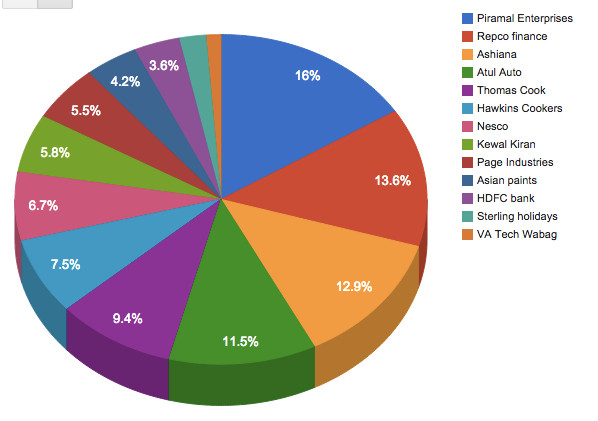

I was a bit slow in deploying the money, but I got enough time (unlike 2009) so that at one point, I had 80% of my non-Tapprs money in equities. The portfolio was largely based on these ideas:

- asset light, clean, growing balance sheets with positive cashflows

- housing, housing finance, housing material companies esp in smaller cities

- growing demand in smaller cities & rural areas

- travel

- consumption plays

NOTE: Piramal enterprises and Thomas Cook are exactly “The Outsider” type of companies. That is also why I own them.

Over the next few months, I took it a step further by having my company pay back all the loans it owed me and deployed that in the market too. Tapprs turned debt-free in that process.

What happened over next 1 year

Several of those investments went at least 2x up. What’s even more important – I will pay no tax as my holdings are now older than 1 year. I cannot do that in my own business.

Mistakes

There were mistakes too. I had sold out of my positions early in Cera Sanitaryware, Astral and VST Tillers. My discomfort grew with higher valuations, but the sell out was largely because it was a heavily borrowed conviction. Borrowed conviction doesn’t help you to stay tight.

Also, I made significant investments in Speciality restaurants, but soon realized where I was getting it wrong (Anjan is such a passionate guy and was trying hard to improve things, but numbers weren’t just happening) and got out of that position early in 2014.

Net-net, I am glad I took the equity route (and not my own business). Of course, it involved luck to a good extent :). My 2008-9 bear market experience helped me quite a bit in withstanding daily-falling prices and in avoiding cheap average quality companies. I only got into what I thought were high quality companies.

Now, that puts me in a stronger position with more options – I could decide to sell equity and put that back into my company. Or I could hold them longer.

However, I will be sure to ask this question: “which is the best option to put my next Rupee into?”.