Quite a few times, I bump into people who want to start their own small business. And many are clueless about how much they would need to start a business.

It’s not rocket science. Also, you don’t have to know everything to start some business – you can learn on the job. That said, here is a short post on what it could take to setup a small business such as a lending library.

I am talking of a small lending library, one that is unsure of its future and hence is starting small with barebones inventory, interiors, etc. No frills. No jazz. No freebies.

The initial setup cost:

Now, you could setup a nice cozy space with good ambience and a great online portal. Or you could simply start – get a few customers and grow from there. I would prefer the latter.

So we start with nearly nothing – just books, some space and an employee. In Bangalore, you have to pay at least 20,000 for some decent space. You could get it cheaper, but since a library is also a community space, I think I’d go ahead and spend this much on rentals. The killer is the advance – but these days you could negotiate a 6 months advance. Legal work, you could delay a bit – but stuff like Shops & establishment are mandatory – just for you to know. At the least, you’d need to account for these:

- Office advance: Rs 150,000

- Minimal furniture: Rs 15,000

- Computer, printer, etc: Rs 20,000

- Legal work: Rs 20,000

- Miscellaneous stuff: 20,000

- Website, hosting: 5,000 (we should really invest in a good site and backend automation, but that can wait)

Total so far: Rs 230,000. However, remember – all budgets go out of hand unless you keep a hawk-eyed control over it.

Note: You could also run it from a garage at home for zero rental cost. I am not considering that.

Inventory:

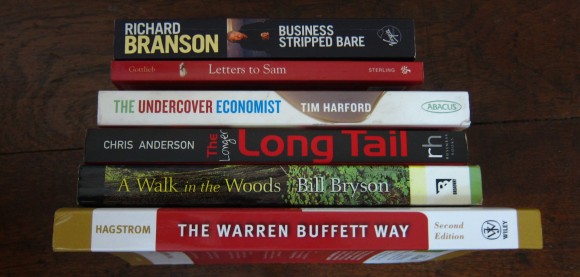

Next comes the biggest thing you will pay attention to – your book inventory and storage systems such as racks.

I would really think of getting deeper into 5 or 6 categories first rather than spreading myself thin into many. I would also pay attention to the kind of readers I would want to attract – kids? entrepreneurs? fiction-lovers? busy & working couples (you have to then think of home delivery seriously)? Whatever – have an idea of who you want to attract and buy only those things that can serve them – not your favorite books on French Revolution and American Renaissance.

Ideally, you should figure out how to source your books real cheap – an advantage you will have over any competitor in the long run – cheaper costs. But if you’re finding the going hard, just spend small amounts on many sourcing options and learn on the job – no point in losing time trying to optimize everything to the hilt.

So, I would think of how many books to stock initially to attract a crowd. Ideally, the least possible – say 1000 books. Or 2000 or 5000 – whatever suits your pocket and risk appetite. I will go with 1000 here at an average cost of Rs 250/book. (If you get good books for cheaper than that, you are doing great).

So, you just spent Rs 250,000 on books. Hey, you need to store them on shelves. Lets just cheap out and buy those low priced Rs 1500 metal racks. Each of them carry about 150 books – lets buy 6-7 of them. Rs 10,500 gone (including transport). Total – Rs 260,500.

You haven’t even started yet and you have already spent Rs 490,500.

Let’s round it off. Initial setup cost including inventory – Rs 500,000.

Note: If you want to start with 2000 books, double the inventory cost to 520,000. Or if you want 5000, make that Rs 1,300,000. I doubt if you’d get economics of scale for 5000, but if you do, adjust for it a bit – maybe 15% less or so. Only if you think you could manage it upfront.

Operational expenditure:

Now, its time to start operating. You have a space. You have to hire an employee (I’d hire two if I were to start today, but you don’t have to. Maybe you don’t even have to hire anyone – just run it yourself. But plan to have an employee soon – running all by yourself even after few months is a bad idea).

I would split the monthly expenses into

- Rent – Rs 20,000

- Payroll – Rs 20,000 (make it 10 if you have 1 employee only)

- Marketing – Rs 5,000

- Operations – Rs 10,000 (phone, internet, electricity, website hosting, daily expenses, etc)

- Administration – Rs 5,000 (CA fee, etc)

- Technology – Let us defer spending on a fantastic site and awesome automation until we have 250 customers.

Total operational expenses per month : Rs 60,000. That’s roughly 720,000 assuming you keep it that way. (You will have to spend on technology to have a nice website and automate your backend though).

So, if you’re going to keep 6 months of expenses in your bank account, you will need 360,000 plus the setup amount of Rs 500,000 to start your business. That means, even before you start, you need Rs 860,000. If you want more inventory – you need even more.

Of course, if you start from home with books you already have and take help from friends and such, you can do with much less. But let us account for the cost of setting up a decent small library.

Note: There are always hidden costs you never thought about. Credit card acceptance charges, repairs, damages and what not. It’s hard to talk about such in this post. But be aware – keep a hawk-eyed control on your expenses.

Now, the real tough part – getting customers:

You know your lending library is going to cost 500,000 to setup. And your annual expenses are going to be to the tune of Rs 720,000.

I would look at a business in these stages:

- Setup a prototype and be ready for customers

- Sign-up customers regularly

- Cashflow positive on an rolling 3 month basis (excluding capex / inventory expenses)

- Profitable and cash-flow positive including capex expenditure

I would be very wary of expanding without hitting 3. These days, people don’t think that way – for eg, Flipkart. But we have shallow pockets and lets not venture into shark waters.

Now comes the pricing – for a new library, you will have to have a good pricing – say 1000 annually for an average customer (many libraries I know charge 2500+). Also, you may charge them some 400-500 as deposit which creates a nice cushion of cash-flow – but remember, this will have to be returned any day to them – this is just an interest free loan to you, something we call float in business :). Remember – float is awesome!

At the worst, your business has to cover up for your operational costs. That is 720,000 annually – which means you need to have at least 720 customers just to cover for your running costs.

Now, every 3 months, you will probably invest more in inventory – I would try to gauge the business:

- Is it growing?

- Am I getting more people, but losing out because my collection is small?

- Is my marketing paying off? Should I do something there?

Assuming that you hit 500 customers, you could attempt a small price hike to say 1250 and slowly move to 1500-2000 range. But you need to also have a growing inventory. Maybe you will invest 100,000 every 2-3 months and add more books.

Automating your business:

For any small business, automation helps bring down costs in the long term. Many overlook this simple aspect. You should invest in a good website and backend automation such as barcodes / RFID tags /etc and start looking at setting up processes that are create a consistent customer experience.

Cashflow positive:

Okay, if you spend 60,000 monthly and get 61 customers paying 1000 each, then you’re cashflow positive at the operational level – but you still spent a lot more on setting up the business and on inventory. The business is still not covering for it.

You need more customers.

The next level is to get to, say Rs 35,000 surplus per month, and then plonk it down into inventory and business automation every 3 months. Now, your future inventory purchases and software automation is being paid for by your business and not your own pocket. Awesome! But remember, for that to happen, you need 95 or more signups every single month!

Next level – now, generate a surplus every 3 months even after spending for your inventory and software. At this stage, your business is beginning to pay back for your initial setup and inventory. Super awesome! If you haven’t been paying yourself a salary, start doing so – you deserve it. For this, you need even more people signing up, say 150 per month.

At the end of the year, if above had happened, you’d have 1800 customers. You’d have generated Rs 1,800,000 plus a float of 800,000 or 900,000. Minus 500,000 for setup. Minus 720,000 in operations. Minus 5-600,000 in adding more inventory and business software (150,000 spent every 3 months). Voila – you covered all your expenses except your salary – the next year is going to be easier because you don’t have setup costs and you have a significant inventory already (you should keep reinvesting). However, remember one point – float is free money and is awesome, but it has to be returned someday – don’t play with it like you own it :).

Also, we haven’t spoken about stuff like home delivery – you could explore this anytime you feel comfortable. But remember, managing home delivery is by itself a separate small business :).

Next level – pay back all your investments till date, cover all your costs and start generating surplus. Forthcoming years, it should make even better profits.

If you got here, you really should be thinking of setting up more places :).

Note: The above is just an oversimplified example just so that you get an idea – for nitty gritties, you have to sit and work it out better.

Comments welcome!

As people moving towards digital world, many will be willing to buy the ebooks than leading it form library.. So people who reads the books might already be an member of the some library, you might need to think how to attract the customer who already been an member of some library .. 😉

Vinoth,

Well – the specifics were about a library – but really the post was about setting up a small business and how to think about handling your finances.

That said, I think physical books are here to stay for quite some time. In a city with a population of 9,000,000+, it is really not hard to get a member base of say 2000, if you get it right.