I have been following Mahindra holidays for quite a while.

They do have an interesting business model.

- Customer pays upfront for timeshare ownership

- Mahindra holidays builds resorts

- Customers get to stay at these resorts for 1 week every year for 25 years (it was 33 years few years ago)

- customer also have to pay an annual fee (increases with price index) and for food and beverages at resort creating an additional recurring revenue stream

- unused rooms are rented to non-members

What this means is:

- company gets upfront money for buying and building resorts

- needs very little external funding, if any

- the resorts need not worry about occupancy rates because the rooms are pre-sold for 25 years (For MH, occupany last quarter was 90% – compare that with regular hotels)

There are 3 sources of funding for any company (4 if you are clever):

- issuing equity

- raising loans

- charging customers for service

- free money in form of upfront payments, delayed vendor payments, insurance premiums, etc

Equity is the costliest; options 3 & 4 are the cheapest. Mahindra Holidays is clever in being able to access 3 & 4 above majorly for its growth.

Note: What looks like loans on its balance sheet is actually deferred revenue (they recognise 60% upfront and 40% is deferred).

Now, that’s a dream-like business model. It’s an asset heavy business, but you’re getting money from customers upfront to build it and then service them. They needn’t take much loans or issue much equity at all for incremental funding / growth. How sweet!

As of today, the market cap of the company is 1870 crores. With all those resorts in exotic locations (very good resorts, my research tells me) and a bit of land bank and a nearly monopolistic brand name in this business (Sterling holidays is trying a catchup / comeback, but far behind still), I do think it has good value.

The question is – is it good enough to create even more value in the future?

There are few concerns, esp 3:

- members to room ratio is still on higher side. They need more rooms. This is causing negative publicity for them – some even calling them frauds on social media. They have 2399 rooms as per their last presentation and 163303 members. The ratio is a high 68. I would like to see it drop below 50 (which means adding 850 rooms) – this may never happen. A lot of members don’t take vacations every year and the management thinks it can get away with this room ratio – if you see the management’s comment on this topic.

- I see receivables > 6 months of Rs 292 crore on its balance sheet as on Mar 31, 2013. Now, they say its good and can be collected. I am not so sure. My guess is, at least a bit of that amount is not coming home – courtesy disgruntled members and a slowdown in economy. I wish they provisioned for it conservatively. Compared to its topline of 715 crores last year, this is a significant amount.

- their sales & marketing cost is 36%!! It’s a heavily (mis)sold product. Even my relative, who is not much of a traveller was sold one. He just succumbed to too much sales pressure I guess.

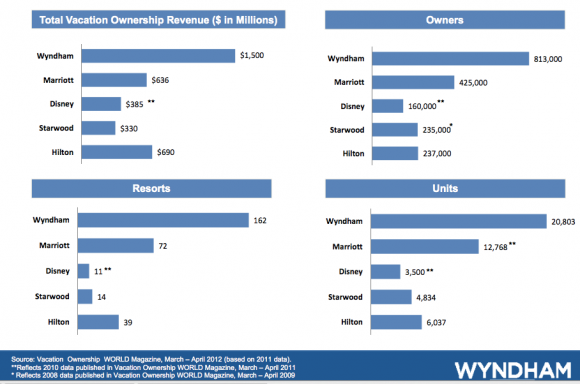

Update: Compare the member-room ratio to other players around the world.

Room-to-member ratio of leading players around the world

- Wyndham (largest) – 39.08

- Mariott – 33.28

- Disney – 45.7

- Starwood – 48.6

- Hilton – 39.26

Almost all of them have it in early 40’s or lower. 68 of Mahindra holidays is just way too high!

One may argue that the above factors are ‘priced-in’ given that the market cap is now at 1870 crores. I am convinced there’s value as of today, but am still not convinced of how much additional value creation there can be.

I would like to see these things happen in 3-4 years:

- an increase in recurring revenue portion of topline and reduced dependency on just sales of new memberships

- company being slightly conservative about receivables and provisioning for it. Also, I think booking 60% revenue upfront is aggressive too (Sterling books 50% upfront). I’d like to see some conservativeness here.

- addition of some 1500 rooms, even possibly taking small loan to get it done in phases. I don’t know how much capex that would be.

- add members from now-on at 40% members/rooms rate for 4-5 years (60,000 members for above mentioned 1500 rooms). This will bring down overall members to rooms ratio to 55%. This should add at least 2250 cr over next few years. Plus add to it the recurring revenue bit – which over 5 years could be another 1300+ crores.

I need to think a bit on how to value this company.

- maybe figure out membership payments and resort income for several years ahead and discount free cashflow back. This needs too many levers to be considered like a drop in margins due to lower non-member rentals, an inflation led hike in pricing, member cancellations, reduction in sales & marketing with increasing referrals, estimating capex on new resorts, etc. I am yet to think deeply on those terms. At best, this should be a wildly varying figure.

- value the land bank and resorts – this is just not possible. Too many resorts, across the country and valuations will be misleading. Also, I think it will exceed the current market valuations.

- since the new member payments will almost always be used for building more resorts, there should be a period when it has reached a threshold no of rooms (I think it could be 10,000 – 12,500 rooms). The actual free cashflow after this period should be much higher since the capex will mostly be maintenance then (new members will be added, but resorts are built already). This seems to be away by at least 10-15 years.

- we need to think what will happen to the space if Sterling is bought out by a larger international player (remember, Sterling is run by Bay Capital and at best they are a revolving door management playing for the turnaround pop)

- direct entry of an international player seems not so much of a feasibility given the time and money needed to build this business

For any entrepreneur, it’s a very lucrative business model for sure, if done well.

Few useful links:

Wyndham presentation

So should we invest inCM shares? What position should one take here

Thats upto you.

I am neither an investment advisor nor an authority on the subject – so its dangerous for you to ask me that question.

From last years AR:

Income from sale of vacation Ownership: Rs 4,458,558,633 (445.8 cr)

Note: There’s a deferred revenue portion too, but let’s keep it aside for now.

Compare that figure with expenditure incurred to make that happen:

Advertisement: Rs 100,621,753

Sales commission: Rs 328,710,946

Sales promotion expenses: Rs 1,315,502,630

————————————————————–

Total : ~175 cr

Nearly 40% of the amount was used up for selling the product.

Now, there are 2 ways of thinking about it:

1. Any competition will find it very hard to match these sales promotion activities. Plus add to it the funds needed to set up the first few resorts to attract customers (which will then self-fund next leg of resort building).

2. This is way too much being spent on selling. The amount of money involved is often high that makes greedy sales people mis-sell the product – which is actually very common with CM / Sterling vacation ownership.

How do you want to interpret it, I will leave it to you :).

ya even i was called by these guys couple of times asking me to take a membership….it is also interesting to note one player who is in this space who can potentially come to this segment is your Tata group. They have the inventory, they have the brand, their stock is going down due to poor financial performance…perfect time to enter this segment?

Updated the post with data from other vacation ownership companies around the world. Almost all of them have member-room ratio below 45. At 68, Mahindra holidays is just way too high.

To sustain the hype create out of marketing you need money. Issuing equity is not costliest when you know your business is overvalued. That’ why they run for IPO on first revival of market in 2009. Mahindra Holidays get money from members in advance to build resorts, they still struggled to create new capacity in 2007-2010, until IPO money was in their hand, why they needed IPO money and further equity sale to Institutional Investors (SEBI’ 25% float is not the only reason) and still their room-member ratio is so skewed. Part of money spent in building land bank, will not give more then 10-12% return on the investment, a poor business but necessary for survival.

>There are few concerns, esp 3:

>members to room ratio –

Is’t it Chicken-egg situation? Is it members are not holidaying as not enough rooms or CM is not building rooms because members are not coming to holiday? Is it not a question on business ethics?

What if they got to build these 850 rooms, from where they will get money? Will resort quality suffer? Are they running Ponzi scheme, satisfy one customer at the cost of others? How may customer days lapse every year?

>I see receivables > 6 months of Rs 292 crore on its balance sheet as on Mar 31, 2013.

You need to compare it with bottom line, as any amount goes bad it will need to be subtracted from bottom line. Look at change in ‘Trade and other receivables’ in Cash Flow statement. I do not know why many equity analysts have ignored this. What if half of it goes bad, it means they are over stating their profit by ~25%.

>Their sales & marketing cost is 36%!! –

39% of new vacation sales goes to Adv+ Sales+ Promotion (excluding mgmt cost, office rental, and other office expenses?)

Income from sale of vacation Ownership 4,460,680,941

Advertisement 102,633,593

Sales commission 329,553,316

Sales promotion expenses 1,315,581,785

>One may argue that the above factors are ‘priced-in’ given that the market cap is now at 1870 crores. I am convinced there’s value as of today, but am still not convinced of how much additional value creation there can be.

It looks like this valuation is arrived by price anchoring. I do not see any analysis supporting this valuation.

>I would like to see these things happen in 3-4 years:

>An increase in recurring revenue portion of topline and reduced dependency on just sales of new memberships.

Ideally it will never happen (in current model), unless their other (travel) businesses grows. Resort income and membership income cannot grow independently.

>Company being slightly conservative about receivables and provisioning for it.

I believe it will cut profit by atleast 25%.

>Also, I think booking 60% revenue upfront is aggressive too (Sterling books 50% upfront). I’d like to see some conservativeness here. –

Income tax dept wanted them to book 100% profit. I do not think it changes any business fundamental.

>Addition of some 1500 rooms, even possibly taking small loan to get it done in phases. I don’t know how much capex that would be. –

That would require 600Cr to 900Cr. ( 40- 60 Lakh per room)

>Add members from now-on at 40% members/rooms rate for 4-5 years (60,000 members for above mentioned 1500 rooms). This will bring down overall members to rooms ratio to 55%.

It should 40 Members – not 40%, what will be its impact on debt and profit?

I will value their business as =

self owned rooms + vacant land + other income=

(1600* 50 Lakh) 800Cr + 200 Cr Land + 12(price multiple)x 30Cr = 1360Cr ~ 155 per share

As long as there is not much margin improvement and growth visibility, I will value then conservatively based on assets only.

I wish they need to move from this time share to a family holiday resort company with discounts to attract senior citizens during lean time and premium charges during school holidays! This time share looks like getting married in days of live in!